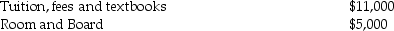

Tom and Anita are married, file a joint return with an AGI of $165,000, and have one dependent child, Tim, who is a first-time freshman in college. The following expenses are incurred and paid in 2014:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Records

A database term referring to individual entries that represent specific instances of the data model, each with a unique set of field values.

Visual Basic Editor

An Integrated Development Environment (IDE) used for programming in Visual Basic and creating macros in Microsoft Office applications.

Access Module

A component within Microsoft Access that contains VBA (Visual Basic for Applications) code to automate tasks or add functionalities.

Form Design View

A workspace in database applications where users can create or modify the structure of a form by adding or arranging fields, labels, and other elements.

Q15: What is the purpose of Treasury Regulations?

Q20: Taxpayers who change from one accounting period

Q24: A corporation has the following capital gains

Q35: If a taxpayer's total tax liability is

Q41: If a corporation reports both a NLTCG

Q56: Mick owns a racehorse with a $500,000

Q63: Discuss why a taxpayer would want to

Q80: Dividends paid from most U.S. corporations are

Q96: During the course of an audit, a

Q137: Atomic Corporation is enjoying a very profitable