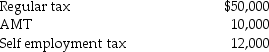

Beth and Jay project the following taxes for the current year:

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a. Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b. Preceding tax year-AGI of $155,000 and total taxes of $50,000.

Definitions:

Interviewers

Individuals who ask questions and conduct conversations, often for the purposes of gathering information, research, or for job candidate selection.

Cognitive-Behavioral

A therapeutic approach that seeks to modify negative thoughts and behaviors by challenging and changing them.

Minnesota Multiphasic Personality Inventory

A comprehensive psychological assessment tool used to diagnose mental disorders and assess personality structure.

Concurrent Validity

The degree to which the results of a particular test or measurement correspond to those of a previously established test or measurement performed at the same time.

Q4: Richard has a 50% interest in a

Q21: Interest is not imputed on a gift

Q39: Identify which of the following statements is

Q41: For purposes of nontaxable exchanges, cash and

Q45: In August 2014, Tianshu acquires and places

Q54: Pamela owns land for investment purposes. The

Q69: The general business credit includes all of

Q81: With respect to charitable contributions by corporations,

Q100: Interest is not imputed on a gift

Q103: All C corporations can elect a tax