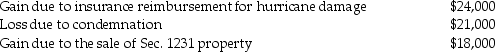

The following gains and losses pertain to Jimmy's business assets that qualify as Sec. 1231 property. Jimmy does not have any nonrecaptured net Sec. 1231 losses from previous years, and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

Weekly Operating Profits

The profit a company makes from its operations in a week, excluding non-operational revenues and expenses.

Market Price

The current price at which a good or service can be bought or sold in a particular market.

Long Run

A period in economic analysis where all factors of production and costs are variable, allowing full adjustment to changes.

Weekly Operating Profits

Weekly operating profits describe the earnings a business generates from its normal operations over a one-week period, excluding any income from investments or other non-operational sources.

Q34: Carlotta, Inc. has $50,000 foreign-source income and

Q39: Under UNICAP, all of the following overhead

Q44: Research has shown that the best performers

Q50: Worthy Corporation elected to be taxed as

Q50: Sarah owned land with a FMV of

Q61: Layla earned $20,000 of general business credits

Q66: Identify which of the following statements is

Q79: A taxpayer may use a combination of

Q81: On January l Grace leases and places

Q124: The Internal Revenue Code of 1986 contains