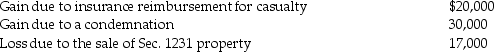

The following are gains and losses recognized in 2014 on Ann's business assets that were held for more than one year. The assets qualify as Sec. 1231 property.

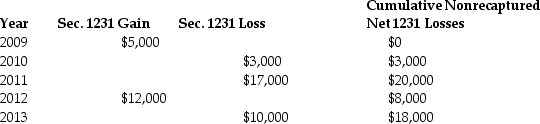

A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Q2: Slimtin Corporation has $400,000 of regular taxable

Q9: A taxpayer must use the same accounting

Q26: Adam Smith's canons of taxation are equity,

Q40: On January 3, 2011, John acquired and

Q41: The Tax Court departs from its general

Q51: On May 18, of last year, Carter

Q78: Which of the following businesses is most

Q78: Galaxy Corporation purchases specialty software from a

Q89: The taxpayer need not pay the disputed

Q90: Which of the following best describes the