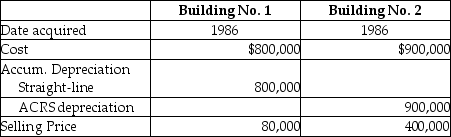

An unincorporated business sold two warehouses during the current year. The straight-line depreciation method was used for the first building and the accelerated method (ACRS) was used for the second building. Information about those buildings is presented below.  How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

Definitions:

Coordination

The organized arrangement of elements or efforts in a process to ensure a smooth operation or outcome.

Resource-Oriented Team

Describes a group of individuals organized with a focus on efficiently utilizing resources (human, technical, financial) to achieve its goals.

Conflict Management Strategies

Techniques and methods used to handle and resolve conflicts in a constructive manner within an organization.

Cooperative Strategy

A strategic approach where organizations or individuals work together towards mutual goals, often involving partnerships, alliances, or collaborative projects.

Q2: Are letter rulings of precedential value to

Q4: Under the MACRS system, automobiles and computers

Q7: Latashia reports $100,000 of gross income on

Q32: A calendar-year corporation has a $15,000 current

Q35: Alex owns an office building which the

Q56: For tax purposes, "market" for purposes of

Q71: Stephanie's building, which was used in her

Q81: Eric dies in the current year and

Q83: A corporation may make an election to

Q83: With respect to residential rental property<br>A)80% or