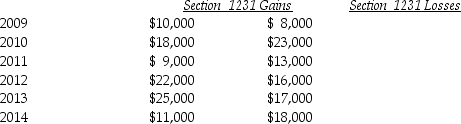

Lucy, a noncorporate taxpayer, experienced the following Section 1231 gains and losses during the years 2009 through 2014. Her first disposition of a Sec. 1231 asset occurred in 2009. Assuming Lucy had no capital gains and losses during that time period, what is the tax treatment in each of the years listed?

Definitions:

Marginal Tax Rate

The marginal tax rate is the percentage of tax applied to your income for each tax bracket in which you qualify, essentially the rate paid on the last dollar of your income.

Average Tax Rate

The percentage of total income that is paid in taxes, calculated by dividing the total amount of taxes paid by the total income.

Regressive

A term usually used to describe a tax system in which the tax rate decreases as the taxable amount increases, effectively placing a higher burden on lower-income earners.

Indirect

Pertains to actions, effects, or financial transactions that are not direct or straightforward, often referring to indirect taxes or costs.

Q4: A corporation sold a warehouse during the

Q12: Assume you plan to volunteer at a

Q13: Pam owns a building used in her

Q19: The term "tax law" includes<br>A)Internal Revenue Code.<br>B)Treasury

Q35: A wage cap does not exist for

Q55: When new tax legislation is being considered

Q76: Atiqa took out of service and sold

Q79: Total Corporation has earned $75,000 current E&P

Q81: On January l Grace leases and places

Q114: Dori and Matt will be equal owners