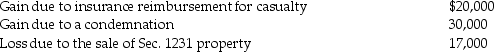

The following are gains and losses recognized in 2014 on Ann's business assets that were held for more than one year. The assets qualify as Sec. 1231 property.

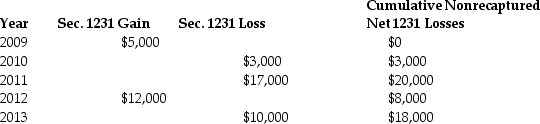

A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

LIFO Conformity Rule

A tax regulation requiring companies that use the last-in, first-out (LIFO) inventory method for tax reporting to also use it for financial reporting purposes.

Tax Purposes

Refers to any considerations made in financial activities or decision-making to optimize tax liabilities.

Financial Statements

Formal records of the financial activities and condition of a business, entity, or individual.

FIFO

First-In, First-Out, an inventory valuation method where goods first bought are the first ones sold.

Q6: Runway Corporation has $2 million of gross

Q11: All of the following statements are true

Q13: Pam owns a building used in her

Q19: Gains and losses from involuntary conversions of

Q27: Anne, who is single, has taxable income

Q49: Explain the difference between expenses of organizing

Q51: The basis of non-like-kind property received is

Q57: What is the difference between a taxpayer-requested

Q82: On July 25 of this year, Raj

Q83: Olivia exchanges land with a $50,000 basis