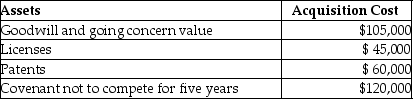

On January 1, 2014, Charlie Corporation acquires all of the net assets of Rocky Corporation for $2,000,000. The following intangible assets are included in the purchase agreement:  What is the total amount of amortization allowed in 2014?

What is the total amount of amortization allowed in 2014?

Definitions:

Slave Codes

Laws established in the American colonies and later in the Southern states that defined the status of slaves and the rights of masters, severely restricting slaves' freedoms.

Enslavement

The state or condition of being a slave; the practice of making someone a slave through force, coercion, or capture.

Justification

The process of proving something to be right or reasonable, often used in contexts of moral, ethical, or legal debates.

Civil Ceremonies

Non-religious ceremonies conducted by a government official or civil celebrant.

Q14: Exit interviews can be used to explain

Q31: Depreciable property includes business, investment, and personal-use

Q53: Discuss the purpose of the imputed interest

Q54: For a business, Sec. 1231 property does

Q66: It is best to ask for proof

Q73: On November 3, this year, Kerry acquired

Q82: Bob owns a warehouse that is used

Q84: All or part of gain realized on

Q88: Leonard established a trust for the benefit

Q100: Jed sells an office building during the