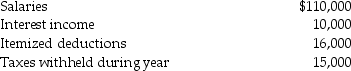

Brad and Angie had the following income and deductions during 2014:

Calculate Brad and Angie's tax liability due or refund, assuming that they have 2 personal exemptions. They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund, assuming that they have 2 personal exemptions. They file a joint tax return.

Definitions:

Self-dealing

Conduct by a fiduciary or a person in a position of trust that involves taking advantage of their position for personal gain at the expense of those to whom they owe a duty.

Agent

An individual or entity authorized to act on behalf of another person or entity, known as the principal, in transactions or legal matters.

Fiduciary Duty

The legal obligation of one party to act in the best interest of another party, such as the responsibility of a trustee to safeguard the interests of the beneficiaries.

Compensation

Payment or rewards provided in exchange for services or to cover losses or damages.

Q9: Rolf exchanges an office building worth $150,000

Q10: Which of the following statements is false

Q23: A professional employer organization (PEO) is like

Q27: Situational interviews assess an applicant's ability to

Q33: A medical examination for employees is defined

Q52: An important advantage of peer assessments is

Q59: Which of the following statements with respect

Q83: Olivia exchanges land with a $50,000 basis

Q87: Emma owns a small building ($120,000 basis

Q99: Emily, whose tax rate is 28%, owns