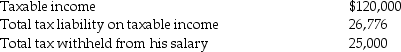

Frederick failed to file his 2014 tax return on a timely basis. In fact, he filed his 2014 income tax return on October 31, 2015, (the due date was April 15, 2015)and paid the amount due at that time. He failed to make timely extensions. Below are amounts from his 2014 return:

Frederick sent a check for $1,776 in payment of his liability. He thinks that he has met all of his financial obligations to the government for 2014. For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,776 in payment of his liability. He thinks that he has met all of his financial obligations to the government for 2014. For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Dorsal

Pertaining to the back side of the body in humans, or the upper side in quadrupeds and other animals.

Ventral

Pertaining to the front or anterior of the body; opposite of dorsal, which refers to the back or posterior.

Caudal

Pertaining to, situated at, or directed toward the tail or the hind part of the body.

Splenius

A muscle located in the back of the neck and upper back that helps in movements such as head rotation and extension.

Q4: Ease of leaving is greater when _.<br>A)

Q15: All of the following transactions are exempt

Q33: Utility analysis models do not take factors

Q39: Eric exchanges a printing press with an

Q70: Prithi acquired and placed in service $190,000

Q72: Which of the following is an attribute

Q78: Which is not a component of tax

Q81: Eric dies in the current year and

Q83: Which of the following is not one

Q106: Personality tests and ability tests are examples