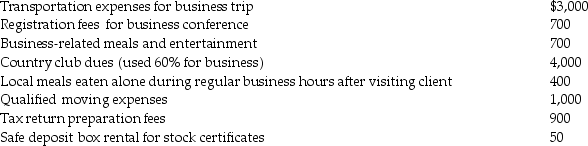

Rita, a single employee with AGI of $100,000 before consideration of the items below, incurred the following expenses during the year, all of which were unreimbursed unless otherwise indicated:  In addition, Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation for the dues. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition, Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation for the dues. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Self-report Methods

Self-report Methods are research techniques that involve participants providing information about themselves, typically through questionnaires or interviews.

Group Cohesion

The bond that connects members of a group together, promoting unity and teamwork.

Military Groups

Organized units in armed forces tasked with defense or combat missions, characterized by structured hierarchy and discipline.

Marching in Formation

The act of individuals moving together in synchronized steps and patterns, often used in military contexts to show unity and discipline.

Q6: A suffix that means instrument for measuring

Q40: Which surgical procedure is used to relieve

Q44: In a basket purchase, the total cost

Q53: The spleen and stomach are located in

Q59: For individuals, all deductible expenses must be

Q63: What must a taxpayer do to properly

Q90: A medical term that means pertaining to

Q90: Terms ending in -um are pluralized by

Q98: Which of the following conditions is a

Q154: The combining form that means cancer is