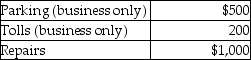

Brittany, who is an employee, drove her automobile a total of 20,000 business miles in 2014. This represents about 75% of the auto's use. She has receipts as follows:  Brittany's AGI for the year of $50,000, and her employer does not provide any reimbursement. She uses the standard mileage rate method. After application of any relevant floors or other limitations, Brittany can deduct

Brittany's AGI for the year of $50,000, and her employer does not provide any reimbursement. She uses the standard mileage rate method. After application of any relevant floors or other limitations, Brittany can deduct

Definitions:

Chest Pain

A common symptom that can be caused by a wide range of health issues, ranging from not serious to life-threatening, including heart attack or indigestion.

Scale Of 1 To 10

A rating system commonly used for subjective assessments, where 1 signifies the lowest, worst, or least intensity, and 10 signifies the highest, best, or greatest intensity.

Pain Medication

Refers to drugs used to alleviate or manage acute or chronic pain.

Incident Report

A documented account of an unusual, unsafe, or unexpected event, often used in the context of health care or workplace safety.

Q2: Marcia, who is single, finished graduate school

Q55: Under the wash sale rule, if all

Q83: Which of the teeth listed below are

Q97: In October 2015, Jonathon Remodeling Co., an

Q100: Which of the following healthcare specialists do

Q103: A passive activity includes any rental activity

Q104: A suffix that means inflammation is _.

Q133: Taxpayers may use the standard mileage rate

Q143: A medical term that means pertaining to

Q168: A suffix that means one who studies