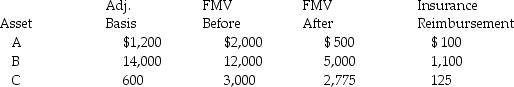

Determine the net deductible casualty loss on the Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2015 and the following occurred:  A and B were destroyed in the same casualty in March. C was destroyed in a separate casualty in July.

A and B were destroyed in the same casualty in March. C was destroyed in a separate casualty in July.

All casualty losses were nonbusiness personal use property losses and none occurred in a federally declared disaster area.

What is the amount of the net deductible casualty loss?

Definitions:

Middle Childhood

A developmental stage in children ranging from about 6 to 12 years old, marked by increased cognitive and social skills.

Concrete Operational

A stage in cognitive development, according to Piaget, where children (around 7-11 years old) start thinking logically about concrete events but struggle with abstract concepts.

Transform Objects

The ability to change or manipulate objects in one's environment, often reflecting cognitive development and creative problem-solving skills.

Piaget

A Swiss psychologist known for his pioneering work in the study of child development, particularly his theory of cognitive development.

Q1: Losses on sales of property between a

Q15: During the current year, Tony purchased new

Q31: Jessica owned 200 shares of OK Corporation

Q49: All of the following losses are deductible

Q55: The combining form bi/o means life.

Q70: Gain on sale of a patent by

Q121: Liz, who is single, lives in a

Q122: Rajiv, a self-employed consultant, drove his auto

Q126: Ashley, a calendar year taxpayer, owns 400

Q152: A suffix that means hardening is _.