Multiple Choice

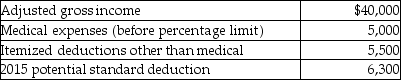

A review of the 2015 tax file of Gregory, a single taxpayer who is age 40, provides the following information regarding Gregory's 2015 tax status:  In 2016, Gregory receives a reimbursement for last year's medical expenses of $1,200. As a result, Gregory must

In 2016, Gregory receives a reimbursement for last year's medical expenses of $1,200. As a result, Gregory must

Definitions:

Related Questions

Q6: If a capital asset held for one

Q36: The discharge of certain student loans is

Q42: Capitalization of interest is required if debt

Q64: Normally, a security dealer reports ordinary income

Q66: Commuting to and from a job location

Q69: Trisha is married and has young children.

Q70: For the years 2011 through 2015 (inclusive)

Q76: Bret carries a $200,000 insurance policy on

Q86: Which abbreviation stands for a blood test

Q98: Dividends on life insurance policies are generally