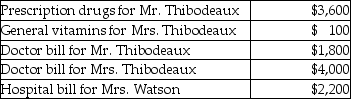

Mr. and Mrs. Thibodeaux, who are filing a joint return, have adjusted gross income of $75,000. During the tax year, they paid the following medical expenses for themselves and for Mrs. Thibodeaux's mother, Mrs. Watson (age 63) . Mrs. Watson provided over one-half of her own support.  Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Definitions:

Q14: Which combining form means female?<br>A) gastr/o<br>B) nephr/o<br>C)

Q30: Takesha paid $13,000 of investment interest expense

Q31: Qualified residence interest consists of both acquisition

Q41: Sumedha is the beneficiary of her mother's

Q42: When business property involved in a casualty

Q42: Capitalization of interest is required if debt

Q53: During the year, Mark reports $90,000 of

Q98: Which of the following conditions is a

Q105: Joycelyn gave a diamond necklace to her

Q131: Chuck, who is self-employed, is scheduled to