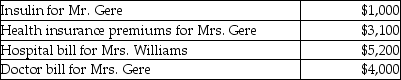

Mr. and Mrs. Gere, who are filing a joint return, have adjusted gross income of $50,000. During the tax year, they paid the following medical expenses for themselves and for Mrs. Gere's mother, Mrs. Williams. The Gere's could claim Mrs. Williams as their dependent, but she has too much gross income.  Mr. and Mrs. Gere received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Mr. and Mrs. Gere received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Definitions:

Brain Chemistry

Refers to the complex interactions of chemicals, neurotransmitters, and hormones within the brain that influence thoughts, emotions, and behavior.

Smooth Muscle

A type of muscle found within the walls of organs and structures such as the stomach, intestines, and blood vessels, controlling involuntary movements.

Voluntary

Actions or decisions made by free choice, without external coercion.

Cardiac

Relating to the heart and its functions in health and disease.

Q5: David has been diagnosed with cancer and

Q27: Constance, who is single, is in an

Q28: In 2015, Sean, who is single and

Q57: Travel expenses related to temporary work assignments

Q63: All realized gains and losses are recognized

Q66: Which of the choices below is NOT

Q67: The middle layer of the eyeball is

Q110: Which of the following is not excluded

Q111: Abby owns a condominium in the Great

Q114: Which of the following is true about