Short Answer

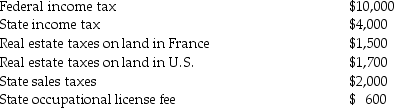

During the current year, Deborah Baronne, a single individual, paid the following amounts:  How much can Deborah deduct in taxes as itemized deductions?

How much can Deborah deduct in taxes as itemized deductions?

Definitions:

Related Questions

Q17: Mike, a dealer in securities and calendar-year

Q36: Leo spent $6,600 to construct an entrance

Q42: All of the following are allowed a

Q45: Which of the following terms refers to

Q76: The suffixes -iasis and -osis have the

Q78: On August 1 of the current year,

Q89: An accrual-basis taxpayer may elect to accrue

Q93: All of the following items are excluded

Q95: Sam received a scholarship for room and

Q96: Stock purchased on December 15, 2014, which