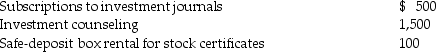

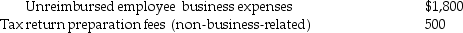

Phoebe's AGI for the current year is $120,000. Included in this AGI is $100,000 salary and $20,000 of interest income. In earning the investment income, Phoebe paid investment interest expense of $30,000. She also incurred the following expenditures subject to the 2% of AGI limitation:

Investment expenses:  Noninvestment expenses:

Noninvestment expenses:  What is Phoebe's investment interest expense deduction for the year?

What is Phoebe's investment interest expense deduction for the year?

Definitions:

Deduction in Damages

A concept in legal disputes where the amount of compensation awarded is reduced due to certain factors, such as contributory negligence or mitigation of loss.

Delivery Expenses

Costs associated with the process of transporting goods from the seller to the purchaser.

Collective Intelligence

The shared or group intelligence that emerges from the collaboration, collective efforts, and competition of many individuals.

Distributed Leadership

A leadership approach where control and decision-making are shared among an expansive group of people, rather than centralized in a single leader.

Q58: When the taxpayer anticipates a full recovery

Q79: At the election of the taxpayer, a

Q85: Ruby Corporation grants stock options to Iris

Q95: Earnings of a minor child are taxed

Q102: Josh purchases a personal residence for $278,000

Q104: If property received as a gift has

Q111: Lisa loans her friend, Grace, $10,000 to

Q112: Carl purchased a machine for use in

Q123: In 2006, Regina purchased a home in

Q147: Which combining form means stomach?<br>A) cardi/o<br>B) gastr/o<br>C)