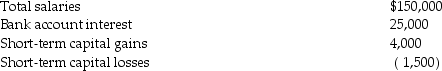

During 2015 Richard and Denisa, who are married and have two dependent children, have the following income and losses:  They also incurred the following expenses:

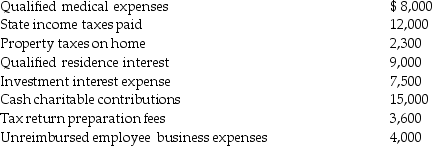

They also incurred the following expenses:  Compute Richard and Denisa's taxable income for the year. (Show all calculations in good form.)

Compute Richard and Denisa's taxable income for the year. (Show all calculations in good form.)

Definitions:

Borrowed

Something obtained or received temporarily with the intention of returning it or its equivalent value.

Interest

The expense associated with lending money or the profit from an investment, usually shown as a percentage.

Days

A unit of time equivalent to 24 hours, generally used to measure durations and intervals.

Investment

The allocation of resources, usually money, in expectation of generating income or profit.

Q18: Which abbreviation refers to a mental health

Q29: Generally, gains resulting from the sale of

Q38: All of the following fringe benefits paid

Q55: Capital expenditures for medical care which permanently

Q79: Ivan's AGI is about $50,000 this year,

Q88: Self-employed individuals receive a for AGI deduction

Q103: An employer-employee relationship exists where the employer

Q104: On July 31 of the current year,

Q107: Accelerated death benefits received by a terminally

Q134: Employees receiving nonqualified stock options recognize ordinary