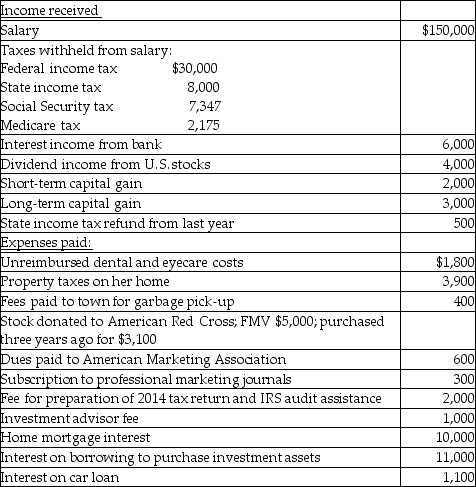

Hope is a marketing manager at a local company. Information about her 2015 income and expenses is as follows:  Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single, and she elects to itemize her deductions each year. Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single, and she elects to itemize her deductions each year. Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Definitions:

Microwave

An electric appliance that uses microwave radiation to heat or cook food rapidly, common in kitchens for its convenience.

Trialability

The degree to which a product can be experimented with on a limited basis before full adoption.

Warby Parker

An American online retailer of prescription glasses and sunglasses, known for its home try-on program.

Premarket Testing

The process of evaluating the market potential of a new product or service before its full-scale launch, often involving selected consumers or client feedback.

Q10: Amy, a single individual and sole shareholder

Q24: Joseph has AGI of $170,000 before considering

Q24: All of the following statements are true

Q51: Edward purchased stock last year as follows:

Q63: Which suffix means tumor or mass?<br>A) -itis<br>B)

Q78: A taxpayer suffers a casualty loss on

Q87: Because of the locked-in effect, high capital

Q111: If Houston Printing Co. purchases a new

Q114: Which of the following is true about

Q127: Gabe Corporation, an accrual-basis taxpayer that uses