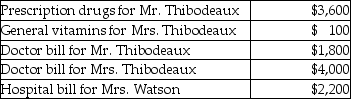

Mr. and Mrs. Thibodeaux, who are filing a joint return, have adjusted gross income of $75,000. During the tax year, they paid the following medical expenses for themselves and for Mrs. Thibodeaux's mother, Mrs. Watson (age 63) . Mrs. Watson provided over one-half of her own support.  Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Definitions:

Function

The specific purpose or activity for which something is used or designed to do.

Partnerships

A business structure in which two or more individuals manage and operate a business in accordance with the terms and objectives set out in a Partnership Agreement.

Competent Manager

An individual who possesses the necessary skills, knowledge, and experience to effectively direct and control business operations.

Previous Business Success

The accomplishments and positive outcomes achieved by a business in its past operations, often used to gauge potential for future success.

Q13: What type of property should be transferred

Q49: Which of the following terms means a

Q62: A change to adjusted gross income cannot

Q65: Jorge owns activity X which produced a

Q93: Why was Section 1244 enacted by Congress?

Q95: Bart owns 100% of the stock of

Q112: Melody inherited 1,000 shares of Corporation Zappa

Q114: With regard to taxable gifts after 1976,

Q134: Galvin Corporation has owned all of the

Q137: All of the following are capital assets