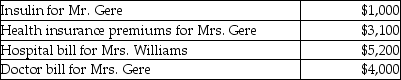

Mr. and Mrs. Gere, who are filing a joint return, have adjusted gross income of $50,000. During the tax year, they paid the following medical expenses for themselves and for Mrs. Gere's mother, Mrs. Williams. The Gere's could claim Mrs. Williams as their dependent, but she has too much gross income.  Mr. and Mrs. Gere received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Mr. and Mrs. Gere received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Definitions:

Q8: Sacha purchased land in 2010 for $35,000

Q21: Daniel purchased qualified small business corporation stock

Q26: What is or are the standards that

Q41: Sumedha is the beneficiary of her mother's

Q48: On January 1 of this year, Brad

Q59: Brandon, a single taxpayer, had a loss

Q81: Donald sells stock with an adjusted basis

Q104: On July 31 of the current year,

Q116: All of the following payments for medical

Q130: Josiah is a human resources manager of