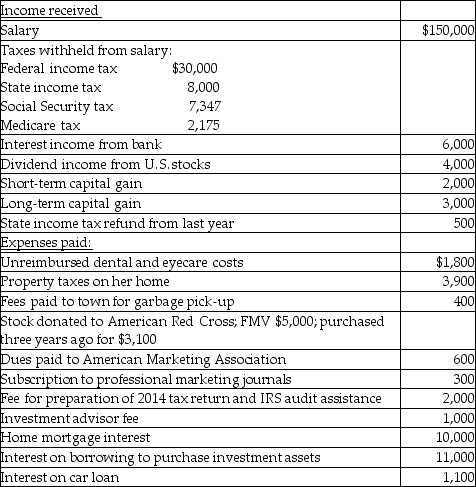

Hope is a marketing manager at a local company. Information about her 2015 income and expenses is as follows:  Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single, and she elects to itemize her deductions each year. Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single, and she elects to itemize her deductions each year. Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Definitions:

Distended Neck Veins

Swollen or enlarged veins in the neck, often a sign of cardiovascular disease or conditions affecting blood flow.

Crackles

Abnormal lung sounds heard with a stethoscope, indicating fluid in the airways.

Tourniquet

A device used to apply pressure to a limb or extremity to limit, but not stop, the flow of blood, often used during surgery or in emergency situations.

Central Venous Access Devices (CVADs)

Medical devices inserted into large veins in the body used for administering medications, fluids, or for drawing blood.

Q29: Patrick's records for the current year contain

Q57: Which type of mental disorder is characterized

Q69: Which endocrine gland is NOT correctly matched

Q69: Jade is a single taxpayer in the

Q88: Olivia, a single taxpayer, has AGI of

Q89: Discuss what circumstances must be met for

Q102: Ron obtained a new job and moved

Q106: All of the following are requirements for

Q110: Which of the following is not excluded

Q122: Super Development Company purchased land in the