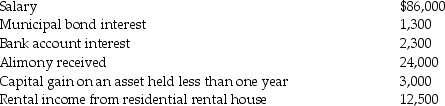

During the current year, Donna, a single taxpayer, reports the following items income of income and expenses:

Income:  Expenses/losses:

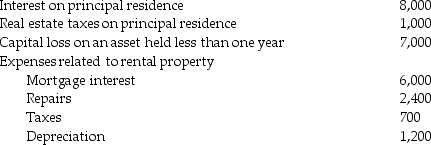

Expenses/losses:  Compute Donna's taxable income. (Show all calculations in good form.)

Compute Donna's taxable income. (Show all calculations in good form.)

Definitions:

Detecting Lies

The process of identifying instances of deception through various means, including verbal and non-verbal cues, and technological aids.

Deception

The practice of deceiving someone through the presentation of incorrect data or by hiding the facts.

Polygraph

A device, commonly referred to as a lie detector, that measures and records several physiological indicators such as blood pressure, pulse, respiration, and skin conductivity while the subject is asked and answers a series of questions.

Mood

A temporary state of mind or feeling that can influence perception, behavior, and overall emotional state.

Q11: To be tax deductible, an expense must

Q23: The amount realized by Matt on the

Q26: When a company manufactures a drug for

Q30: Takesha paid $13,000 of investment interest expense

Q53: The deduction for unreimbursed transportation expenses for

Q76: In addition to Social Security benefits of

Q83: Tess has started a new part-time business.

Q106: If property that qualifies as a taxpayer's

Q120: If a taxpayer's method of accounting does

Q123: In 2006, Regina purchased a home in