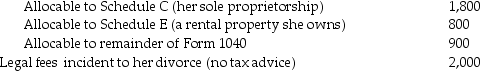

During the current year, Lucy, who has a sole proprietorship, pays legal and accounting fees for the following:  Services rendered in resolving a federal tax deficiency

Services rendered in resolving a federal tax deficiency  Tax return preparation fees:

Tax return preparation fees:  What amount is deductible for AGI?

What amount is deductible for AGI?

Definitions:

Rate Variance

Refers to the difference between an actual rate and a standard or expected rate, often used in budgeting and financial analysis to understand variances in performance.

Direct Labor Hours

The total hours of labor directly involved in the manufacturing of a product, directly tied to the production process.

Direct Materials Price Variance

The cost associated with the difference between the actual price and the standard price of direct materials multiplied by the actual quantity of direct materials used in producing a commodity.

Direct Materials

Raw materials that are directly traceable to the manufacturing of a product and constitute a significant portion of the production cost.

Q1: Michael is an employee of StayHere Hotels,

Q28: Which one of the following is a

Q33: On July 1 of the current year,

Q39: Assessments or fees imposed for specific privileges

Q42: Income from illegal activities is taxable.

Q65: Speak Corporation, a calendar year accrual basis

Q68: When a public school system requires advanced

Q77: Donald has retired from his job as

Q77: Gross income is limited to amounts received

Q102: Ron obtained a new job and moved