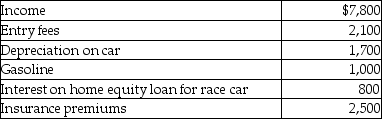

Kyle drives a race car in his spare time and on weekends. His records regarding this activity reflect the following information for the year.  What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

Definitions:

Utility

In economics, the total satisfaction received from consuming a good or service.

Consumer Surplus

The difference between what consumers are willing to pay for a good or service and what they actually pay.

Marginal Utility

The extra pleasure or benefit a customer receives from purchasing an additional unit of a product or service.

Total Utility

The total satisfaction or benefit obtained from consuming a particular quantity of goods or services.

Q9: Which of the following is not generally

Q10: Amy, a single individual and sole shareholder

Q45: Taj operates a sole proprietorship, maintaining the

Q46: Pat, an insurance executive, contributed $1,000,000 to

Q54: Which of the following bonds do not

Q66: Interest on the obligations of the U.S.

Q78: Which of the following is not included

Q83: Incremental expenses of an additional night's lodging

Q95: Earnings of a minor child are taxed

Q101: What factors are considered in determining whether