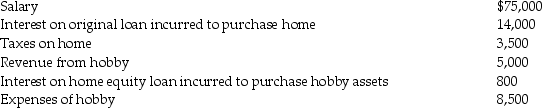

During the current year, Paul, a single taxpayer, reported the following items:  Compute Paul's taxable income for the year.

Compute Paul's taxable income for the year.

Definitions:

Developmental Restructuring

Refers to changes made within an organization or system aimed at improving its effectiveness by altering its structure, processes, or interactions.

Vivid Mental Pictures

Highly detailed and clear images formed in the mind, often evoked by descriptive language or creative thinking.

Positive Imagery

The practice of using vivid and positive mental images to enhance performance, reduce stress, or improve emotional well-being.

Confidence

The feeling of self-assurance arising from an appreciation of one's own abilities or qualities.

Q5: Which of the following credits is considered

Q32: Discuss why the distinction between deductions for

Q33: A taxpayer has low AGI this year,

Q39: Assessments or fees imposed for specific privileges

Q66: The gain or loss on an asset

Q87: An employee has unreimbursed travel and business

Q95: Adjusted net capital gain is taxed at

Q99: As a result of a divorce, Michael

Q110: Paul, a business consultant, regularly takes clients

Q113: When are home-office expenses deductible?