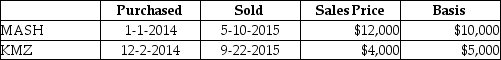

Nate sold two securities in 2015:  Nate has a 25% marginal tax rate. What is the additional tax resulting from the above sales?

Nate has a 25% marginal tax rate. What is the additional tax resulting from the above sales?

Definitions:

Accounts Receivable

Outstanding payments owed to a company by patrons for items or assistance already provided but not yet remunerated.

Debt To Suppliers

Liabilities owed to suppliers from transactions where goods or services were purchased on credit.

Showroom Expansion

involves the physical growth or enhancement of a retail space used to display products for sale, intended to increase customer engagement and sales.

After-Tax Maintenance Cost

The expense associated with maintaining an asset or investment after accounting for the effects of income taxes.

Q3: Corporate taxpayers may offset capital losses only

Q27: Investment interest expense is deductible<br>A) as an

Q35: One-half of the self-employment tax imposed is

Q41: Which of the following factors is important

Q54: Melanie, a single taxpayer, has AGI of

Q57: A taxpayer owns 200 shares of stock

Q63: Keith, age 17, is a dependent of

Q76: If a taxpayer disposes of an interest

Q78: Jake and Christina are married and file

Q101: If a loan has been made to