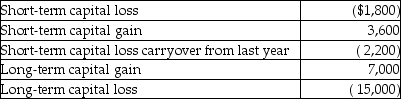

During the current year, Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year, and what is the amount and character of her capital loss carryover?

What is the amount of her capital loss deduction for the current year, and what is the amount and character of her capital loss carryover?

Definitions:

Fair Credit Reporting Act

A federal law designed to ensure accuracy, fairness, and privacy of information in the files of consumer reporting agencies.

Consumer Reporting Agencies

are entities that collect and disseminate information about consumers to be used in credit evaluations and other decisions.

Credit Reports

Detailed reports that include an individual's credit history, showing past and current credit transactions and their repayment record.

Do-Not-Call Registry

A list managed by the government where individuals can register their phone numbers to avoid receiving unsolicited commercial calls.

Q4: Eva and Lisa each retired this year

Q9: Mary Ann pays the costs for her

Q20: Generally, when a married couple files a

Q22: Grace has AGI of $60,000 in 2014

Q35: Nikki is a single taxpayer who owns

Q57: Thomas and Sally were divorced last year.

Q78: Derrick was in an automobile accident while

Q79: Julia, age 57, purchases an annuity for

Q84: A legally married same-sex couple can file

Q90: An example of an AMT tax preference