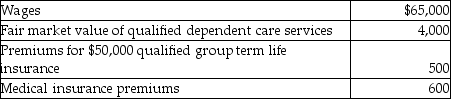

Carl filed his tax return, properly claiming the head of household filing status. Carl's employer paid or provided the following to Carl:  How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis) ?

How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis) ?

Definitions:

Import

The act of bringing goods or services into a country from abroad for sale.

U.S. Tariff

A tax imposed by the United States government on imported or, less commonly, exported goods.

Oil

A viscous liquid derived from petroleum, mainly used for fuel, heating, and lubrication.

Imports

Products or services imported into a country from overseas for the purpose of selling.

Q20: Amy's employer provides her with several fringe

Q33: A taxpayer has low AGI this year,

Q45: The fair value of lodging cannot be

Q50: Dwayne has general business credits totaling $30,000

Q72: In 2015, Richard, a single taxpayer, has

Q73: In the current year, Julia earns $9,000

Q81: Discuss the tax planning techniques available to

Q106: Rena and Ronald, a married couple, each

Q116: Sam and Megan are married with two

Q116: Steve Greene, age 66, is divorced with