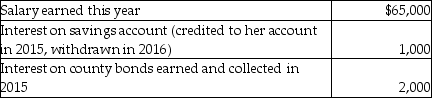

Ms. Marple's books and records for 2015 reflect the following information:  What is the amount Ms. Marple should include in her gross income in 2015?

What is the amount Ms. Marple should include in her gross income in 2015?

Definitions:

Profit

The financial gain achieved when the revenue from business activities exceeds the expenses, costs, and taxes involved in maintaining the operation.

Operating Loss

A financial metric representing the negative balance resulting from a company's operating expenses exceeding its revenues.

Variable Cost

Costs that change in proportion to the level of activity or volume of goods produced, such as raw materials and labor expenses.

Fixed Costs

Expenses that remain constant regardless of the amount of output or sales, including costs like lease payments, wages, and insurance premiums.

Q28: Pierce has a $16,000 Section 1231 loss,

Q31: Rob is a taxpayer in the top

Q56: The value of health, accident, and disability

Q64: Leslie, who is single, finished graduate school

Q78: On August 1 of the current year,

Q79: Julia, age 57, purchases an annuity for

Q79: Ivan's AGI is about $50,000 this year,

Q81: Qualified dividends received by individuals are taxed

Q94: An investor exchanges an office building located

Q135: Silver Inc. is an S corporation. This