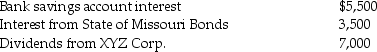

Kevin is a single person who earns $70,000 in salary for 2015 and has other income from a variety of investments, as follows:  Kevin received tax refunds when he filed his 2014 tax returns in April of 2015. His federal refund was $600 and his state refund was $300. Kevin claimed the $300 state tax overpayment as an itemized deduction on his 2014 return. Due to changes in circumstances, Kevin is not itemizing deductions on his 2015 return.

Kevin received tax refunds when he filed his 2014 tax returns in April of 2015. His federal refund was $600 and his state refund was $300. Kevin claimed the $300 state tax overpayment as an itemized deduction on his 2014 return. Due to changes in circumstances, Kevin is not itemizing deductions on his 2015 return.

Compute Kevin's taxable income for 2015.

Definitions:

Cognitive Development

Cognitive development pertains to the growth and change in mental abilities such as thinking, reasoning, and understanding over the course of a person's life.

Language Development

The process by which individuals acquire and refine their language skills over time.

Overregularization

A linguistic phenomenon observed in language development, where children mistakenly apply standard grammatical rules to irregular verbs or nouns.

Whole-Object Assumption

A language learning principle where children assume that words refer to entire objects rather than their parts, properties, or actions.

Q16: The basis of non-like-kind property received is

Q29: Lindsey Forbes, a detective who is single,

Q35: Niral is single and provides you with

Q47: Mike won $700 in a football pool.

Q68: Employers must report the value of nontaxable

Q81: Donald sells stock with an adjusted basis

Q104: Lara started a self-employed consulting business in

Q109: Unemployment compensation is exempt from federal income

Q110: In a common law state, jointly owned

Q125: For purposes of the dependency exemption, a