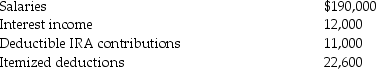

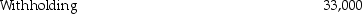

The following information is available for Bob and Brenda Horton, a married couple filing a joint return, for 2015. Both Bob and Brenda are age 32 and have no dependents.

a. What is the amount of their gross income?

a. What is the amount of their gross income?

b. What is the amount of their adjusted gross income?

c. What is the amount of their taxable income?

d. What is the amount of their tax liability (gross tax)?

e. What is the amount of their tax due or (refund due)?

Definitions:

Medical Services

Professional healthcare services provided by doctors, nurses, and health practitioners to diagnose, treat, and prevent illnesses and conditions.

Assisted Living Care

A residential option for seniors who require help with daily activities and personal care but wish to maintain a level of independence, offering a balance of support and autonomy.

Service-Product Continuum

A concept that describes the range between a pure service and a pure product, illustrating how most market offerings consist of a mix of both elements.

Doctor's Office

A medical facility where doctors diagnose and treat illnesses, offer health consultations, and provide preventive care.

Q24: The exclusion for employee discounts on services

Q41: The purpose of Sec. 1245 is to

Q46: Arthur, age 99, holds some stock purchased

Q64: Normally, a security dealer reports ordinary income

Q65: Speak Corporation, a calendar year accrual basis

Q69: This year Jenna had the gains and

Q73: Bill and Tessa have two children whom

Q79: At the election of the taxpayer, a

Q82: Which of the following statements is false?<br>A)

Q119: A taxpayer acquired an office building to