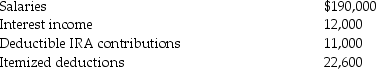

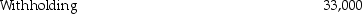

The following information is available for Bob and Brenda Horton, a married couple filing a joint return, for 2015. Both Bob and Brenda are age 32 and have no dependents.

a. What is the amount of their gross income?

a. What is the amount of their gross income?

b. What is the amount of their adjusted gross income?

c. What is the amount of their taxable income?

d. What is the amount of their tax liability (gross tax)?

e. What is the amount of their tax due or (refund due)?

Definitions:

Contradictory Evidence

Information or data that directly opposes or disputes the current understanding, beliefs, or hypotheses.

Different Interpretations

The occurrence of various meanings or understandings of a message or piece of information among different people.

Evidence-Based Management

A practice of making managerial decisions and organizational practices based on the best available evidence from multiple sources.

Potential Virtues

Inherent qualities or traits in individuals that may lead to moral excellence if properly developed.

Q19: The person claiming a dependency exemption under

Q32: Whitney exchanges timberland held as an investment

Q48: Discuss briefly the options available for avoiding

Q54: Rick chose the following fringe benefits under

Q70: Gain on sale of a patent by

Q70: John, who is President and CEO of

Q86: Jay and Cara's daughter is starting her

Q91: The following gains and losses pertain to

Q101: Amounts withdrawn from Qualified Tuition Plans are

Q116: Steve Greene, age 66, is divorced with