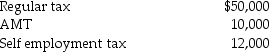

Beth and Jay project the following taxes for the current year:  How much in estimated tax payments (including withholding from wages and quarterly estimated payments) should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments) should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a. Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b. Preceding tax year-AGI of $155,000 and total taxes of $50,000.

Definitions:

Secured

Pertaining to assets or loans that are protected by collateral to ensure repayment or mitigate risk.

Collateral

Assets or property pledged by a borrower to secure a loan or other credit, and subject to seizure on default.

Tender Offer

A proposal by an entity to purchase shares from shareholders of another company, usually at a premium to the market price.

Target's Shares

Equity stakes in the Target Corporation, a publicly traded company known for its retail operations.

Q19: The person claiming a dependency exemption under

Q30: The basis of an asset must be

Q33: For each of the following independent cases,

Q34: Elise, age 20, is a full-time college

Q43: Sean and Martha are both over age

Q59: During the current year, Danika recognizes a

Q66: Kors Corporation has 30 employees and $5

Q100: The unified transfer tax system, comprised of

Q106: Douglas bought office furniture two years and

Q116: Sam and Megan are married with two