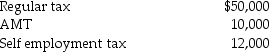

Beth and Jay project the following taxes for the current year:  How much in estimated tax payments (including withholding from wages and quarterly estimated payments) should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments) should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a. Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b. Preceding tax year-AGI of $155,000 and total taxes of $50,000.

Definitions:

Regulated

Controlled or governed by rules, typically in the context of industries or practices subject to oversight by government agencies.

Initial Margin

The minimum amount of equity that must be provided by an investor as part of the terms of a futures contract or other marginable securities.

Futures Contract

A standardized legal agreement to buy or sell something at a predetermined price at a specified time in the future.

Total Value

The comprehensive worth of an asset or company, considering all sources of value including tangible and intangible factors.

Q24: In 2015 Charlton and Cindy have alternative

Q26: While using a metal detector at the

Q27: A check received after banking hours is

Q28: Frasier and Marcella, husband and wife, file

Q35: Nonrefundable tax credits are allowed to reduce

Q50: Ron and Eve are a married couple

Q56: Taxpayers are entitled to a depletion deduction

Q82: Advance approval and the filing of Form

Q92: The sale of inventory results in ordinary

Q102: Kelsey is a cash-basis, calendar-year taxpayer. Her