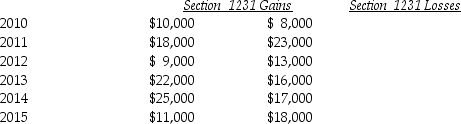

Lucy, a noncorporate taxpayer, experienced the following Section 1231 gains and losses during the years 2010 through 2015. Her first disposition of a Sec. 1231 asset occurred in 2010. Assuming Lucy had no capital gains and losses during that time period, what is the tax treatment in each of the years listed?

Definitions:

Content Validity

Refers to the extent to which a test accurately measures or reflects the specific content of what it is supposed to assess.

Representative Sample

A portion of the population that accurately mirrors the entire group's attributes.

Behavior

The actions or reactions of an individual, usually in relation to the environment, which can be observed and measured from an external standpoint.

Intellectual Disability

A condition characterized by significant limitations in intellectual functioning and adaptive behavior, originating before the age of 18.

Q19: An installment sale is best defined as<br>A)

Q22: Juan's business delivery truck is destroyed in

Q44: Child support is<br>A) deductible by both the

Q51: Benedict serves in the U.S. Congress. In

Q52: An individual buys 200 shares of General

Q71: Bob's income can vary widely from year-to-year

Q98: Paul and Hannah, who are married and

Q98: Vertical equity means that<br>A) taxpayers with the

Q108: If an individual is an employee and

Q116: All of the following are true except:<br>A)