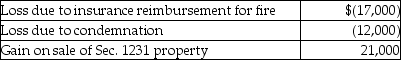

This year Jenna had the gains and losses noted below on property, plant and equipment used in her business. Each asset had been held longer than one year. Jenna has not previously disposed of any business assets.  Jenna will recognize

Jenna will recognize

Definitions:

Young Adults

Individuals in their late teens to early thirties, a stage characterized by transition from adolescence to full-fledged adulthood.

Delta Waves

Slow brainwaves primarily associated with deep sleep and the restorative stage of the sleep cycle.

Deep Sleep

Deep sleep, or slow-wave sleep, is a stage of sleep that is crucial for physical renewal, hormonal regulation, and growth.

REM Periods

Stages of sleep characterized by rapid eye movement, low muscle tone, and the propensity to dream.

Q5: Jillian, whose tax rate is 39.6%, had

Q15: Olivia exchanges land with a $50,000 basis

Q16: The Sixteenth Amendment to the U.S. Constitution

Q25: Under UNICAP, all of the following overhead

Q47: Realized gain or loss must be recognized

Q66: Depreciable property includes business, investment, and personal-use

Q83: All or part of gain realized on

Q84: A taxpayer's tax year must coincide with

Q110: A taxpayer may not avoid responsibility for

Q122: The wherewithal-to-pay concept provides that a tax