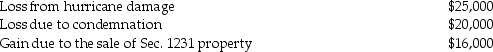

The following gains and losses pertain to Arnold's business assets that qualify as Sec. 1231 property. Arnold does not have any nonrecaptured net Sec. 1231 losses from previous years, and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.  Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

Automatically Accessed

Refers to data or resources that are retrieved or used by a program without explicit instructions from the programmer.

Data Type

A classification identifying one of various types of data, such as integer, floating-point, or string, that determines the possible values for that type, the operations that can be performed on it, and the way it is stored.

Scoping Rules

Guidelines that determine where variables and functions can be accessed within a program, influenced by where they are declared.

Symbolic Constants

Constants whose values are given meaningful names in code, making the code more readable and maintainable, typically defined using the #define directive in C/C++.

Q10: A taxpayer must use the same accounting

Q12: In April 2015, Emma acquired a machine

Q16: Marta purchased residential rental property for $600,000

Q32: Flow-through entities do not have to file

Q33: While federal and state income taxes as

Q73: A business uses the same inventory method

Q94: An investor exchanges an office building located

Q96: All of the following are executive (administrative)

Q105: Jason owns a warehouse that is used

Q139: Which one of the following items is