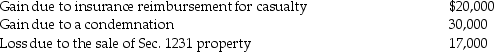

The following are gains and losses recognized in 2015 on Ann's business assets that were held for more than one year. The assets qualify as Sec. 1231 property.  A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:

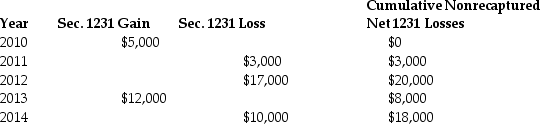

A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:  Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Entrepreneur's Potential Earnings

Represents the possible income or profits an entrepreneur can expect to make from their business ventures, considering risks and the opportunity cost of alternative employment.

Annual Lease

An agreement where a lessor allows a lessee to use a property for a period of one year in exchange for payment.

Entrepreneur's Forgone Interest

The potential interest income sacrificed by an entrepreneur when choosing to invest personal funds into their own business rather than in an interest-bearing account.

Q7: In order for an asset to be

Q31: A taxpayer who uses the LIFO method

Q37: Kyle sold land on the installment basis

Q43: CT Computer Corporation, an accrual basis taxpayer,

Q52: Stephanie's building, which was used in her

Q56: Emma is the sole shareholder in Pacific

Q82: Advance approval and the filing of Form

Q86: Lucy, a noncorporate taxpayer, experienced the following

Q98: Paul and Hannah, who are married and

Q128: Mia is a single taxpayer with projected