Multiple Choice

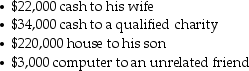

Paul makes the following property transfers in the current year:  The total of Paul's taxable gifts, assuming he does not elect gift splitting with his spouse, subject to the unified transfer tax is

The total of Paul's taxable gifts, assuming he does not elect gift splitting with his spouse, subject to the unified transfer tax is

Definitions:

Related Questions

Q11: In the new classical model, an anticipated

Q15: Aamir has $25,000 of net Sec. 1231

Q24: Which of the following is not a

Q28: The rational expectations hypothesis implies that when

Q39: William and Kate married in 2015 and

Q45: Discuss tax-planning options available for expenses incurred

Q77: On August 11, 2015, Nancy acquired and

Q85: As a result of recent empirical research,

Q87: Points paid on a mortgage to buy

Q112: Discuss the basis rules of property received