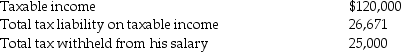

Frederick failed to file his 2015 tax return on a timely basis. In fact, he filed his 2015 income tax return on October 31, 2016, (the due date was April 15, 2015) and paid the amount due at that time. He failed to make timely extensions. Below are amounts from his 2015 return:  Frederick sent a check for $1,671 in payment of his liability. He thinks that he has met all of his financial obligations to the government for 2015. For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,671 in payment of his liability. He thinks that he has met all of his financial obligations to the government for 2015. For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Closing Entries

Journal entries made at the end of an accounting period to transfer temporary account balances to permanent accounts, thereby preparing the accounts for the next period.

Journalized

Refers to the act of recording financial transactions in the company's journal as part of the accounting process.

Accounting Period

A specific duration of time used by businesses for financial reporting and accounting purposes, such as a month, quarter, or year.

Date

A specific point in time that may refer to a day, month, and year, often used in documentation and scheduling.

Q11: The election to use ADS is made

Q16: Lloyd Corporation, a calendar year accrual basis

Q19: An installment sale is best defined as<br>A)

Q34: When the financial crisis started in August

Q50: Why is the aggregate demand curve downward

Q61: Stellar Corporation purchased all of the assets

Q62: Property transferred to the decedent's spouse is

Q69: Suppose the economy is producing below the

Q80: Which of the following increases aggregate supply

Q106: Douglas bought office furniture two years and