Use the following to answer questions .

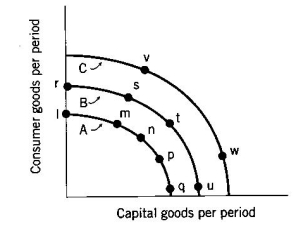

Exhibit: Investment and Production Possibilities

-(Exhibit: Investment and Production Possibilities) Suppose the economy is operating on curve B and there is positive depreciation to its existing capital stock. The decision to produce at point r is likely to

I. shift the production possibilities curve slowly toward curve C.

II. shift the production possibilities curve slowly toward curve A.

III. reduce the economy's capital stock.

IV. result in a negative net private investment.

Definitions:

American Call Option

A financial derivative that gives the buyer the right, but not the obligation, to buy a security at a specified price within a certain time frame.

Exercise Price

The fixed price at which the holder of an options contract can buy (in the case of a call) or sell (in the case of a put) the underlying security or commodity.

ESOs

Employee Stock Options; rights granted to employees to purchase a company's stock at a predetermined price for a specific period.

Convertible Bond

A bond that can be exchanged for a fixed number of shares of stock for a specified amount of time.

Q31: The term "crowding out" refers to the

Q37: (Exhibit: Exchange Rates) Suppose interest rates in

Q57: Members of the European Union<br>A) adopted a

Q89: Suppose in the beginning of 2013, a

Q92: The multiplier is found by dividing the

Q95: (Exhibit: Inflation and Unemployment 2) Which of

Q109: If the efficiency wage theory holds,<br>A) wage

Q118: (Exhibit: Consumption and Real GDP) If real

Q120: If a female professor receives a higher

Q142: (Exhibit: Consumption and Disposable Personal Income) The