Use the following to answer questions .

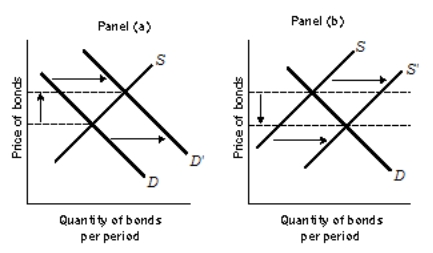

Exhibit: The Bond Market

-(Exhibit: The Bond Market) Suppose the Fed takes action that shifts the demand curve from D to D′, as illustrated in Panel (a) . What happens to the interest rate?

Definitions:

Maturity

The date on which a financial instrument, such as a bond or loan, is due to be repaid in full.

Operating Line of Credit

A flexible loan from a bank that provides a maximum loan balance that the borrower can access for its short-term capital needs.

Company's Liquidity

An indicator of a company's ability to meet its short-term financial obligations, ensuring it has enough cash or liquid assets.

Interest (Finance) Expenses

Costs incurred by an entity for borrowed funds; these expenses may include the cost of debt or loan interest payments.

Q35: Money that some authority, generally a government,

Q85: What is the difference between the aggregate

Q100: An increase in the supply of money

Q109: Investment represents a choice to consume less

Q124: Which of the following will not a

Q129: If you earn and spend $300 per

Q130: The deposit multiplier is the inverse of<br>A)

Q137: In the federal penitentiary at Lompoc, California,

Q149: (Exhibit: Fiscal Policy Options) If the aggregate

Q175: During an economic expansion,<br>A) higher income tax