Use the following to answer questions .

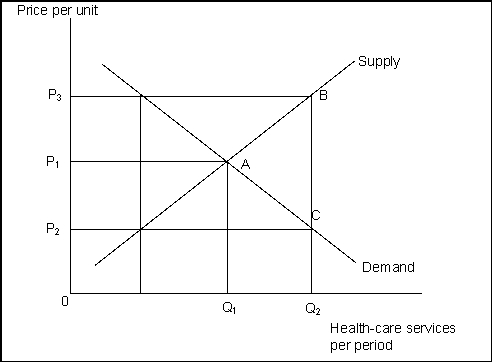

Exhibit: The Market for Health Care

-(Exhibit: The Market for Health Care) Based on the exhibit and assuming that there are no third-party payers:

Definitions:

Proportional Tax

A tax system where the tax rate remains constant regardless of the amount subject to tax, causing taxpayers to pay the same percentage of their income irrespective of its size.

Deductions

Expenses subtracted from gross income to determine the taxable income.

Excise Tax

A tax levied on certain goods, services, and activities, such as tobacco, alcohol, and fuel, usually to discourage their consumption and raise government revenue.

Local Property Tax

A tax assessed on real estate properties, usually levied by local government entities such as cities or counties.

Q28: The short-run aggregate supply curve slopes upward

Q39: If the current price is less than

Q46: Third-party payments have led to an increase

Q76: Using the aggregate demand-aggregate supply model, predict

Q78: The short-run aggregate supply shows the amount

Q105: The long-run aggregate supply curve is vertical

Q131: (Exhibit: Long-run Equilibrium) The potential output in

Q141: (Exhibit: Simultaneous Shifts in Demand and Supply)

Q142: The natural rate of unemployment:<br>A) is generally

Q185: A surplus is a result of equilibrium