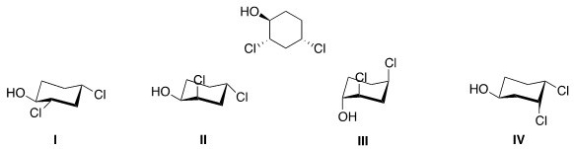

Which of the following is the most stable conformation of the following compound?

Definitions:

Charitable Nonprofits

Organizations that operate for the public benefit and are exempt from federal income tax under section 501(c)(3) of the Internal Revenue Code, focusing on charitable, educational, or religious purposes.

Section 501(c)(3)

Section 501(c)(3) refers to a portion of the U.S. Internal Revenue Code that grants tax-exempt status to nonprofit organizations that meet certain criteria, primarily those engaged in charitable, religious, educational, or scientific activities.

Expenditures

The act of spending or disbursing money, often categorized into capital and operational expenses in both personal and organizational contexts.

Charitable Giving

The act of donating money, goods, services, or time to a cause believed to benefit society, often performed without the expectation of direct financial benefit.

Q3: A master production schedule shows the following

Q8: What is the name of the social

Q9: Which of the following species cannot act

Q11: Which of the following species can be

Q18: What is a key factor that must

Q24: A specific analysis of the total greenhouse

Q24: Which of the following statements about bonding

Q27: What is the starting material in the

Q40: Constant changing of the master schedule and

Q48: Which of the following structures contains an