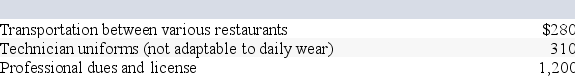

Colby is employed full time as a food technician for a local restaurant chain.This year he has incurred the following expenses associated with his employment:

Colby was reimbursed $125 of the expenses from his employer's accountable plan.How much of the expenses are deductible by Colby?

Colby was reimbursed $125 of the expenses from his employer's accountable plan.How much of the expenses are deductible by Colby?

Definitions:

Public Choice Theory

A framework that applies economic principles to political processes, understanding government behavior through the lens of economic incentives and human behavior.

Government-Owned Companies

Businesses that are owned and operated by the government rather than private individuals or organizations.

Health and Safety Laws

Regulations and standards designed to prevent accidents and injuries in the workplace, ensuring a safe working environment.

Private Companies

Businesses owned by individuals or groups not traded on public stock exchanges, often characterized by private ownership and restrictions on share transfers.

Q18: The Dashwoods have calculated their taxable income

Q19: Due to the alternative minimum tax rate

Q21: Atlas earned $17,300 from his sole proprietorship

Q22: The MACRS depreciation tables automatically switch to

Q48: In 2019, Madison is a single taxpayer

Q59: Which of the following statements about a

Q68: Fran purchased an annuity that provides $12,000

Q80: The time value of money suggests that

Q82: All business expense deductions are claimed as

Q83: Lenter LLC placed in service on April