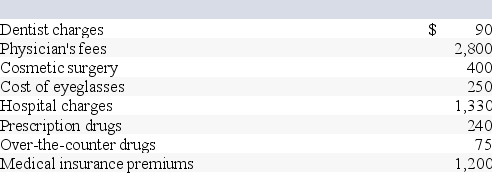

Jenna (age 50)files single and reports AGI of $40,000.This year she has incurred the following medical expenses:

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Definitions:

The American Century

A term popularized by Time publisher Henry Luce in 1941, describing the 20th century as a period dominated by the United States in political, economic, and cultural influence worldwide.

Postwar Prosperity

The period of economic growth and widespread welfare experienced by many countries following the end of World War II.

Free Enterprise

An economic system where private businesses operate in competition and largely free of state control, emphasizing the importance of a market economy.

Defense Department

The part of the United States government responsible for implementing military policies and maintaining armed forces.

Q8: Redoubt LLC exchanged an office building used

Q15: Which of the following depreciation conventions is

Q24: Jasmine and her husband, Arty, have been

Q25: Which of the following does not ultimately

Q42: Why does §1250 recapture generally no longer

Q43: Tax rate schedules are provided for use

Q56: Gabby operates a pizza delivery service.This year

Q82: The income-shifting strategy requires taxpayers with varying

Q83: Braxton owns a second home that he

Q90: A deferred like-kind exchange does not help