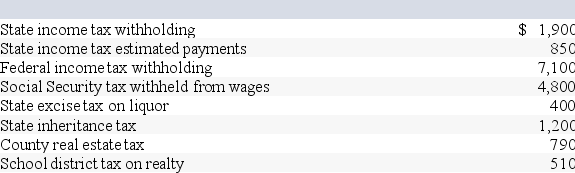

Chuck has AGI of $70,000 and has made the following payments this tax year:

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Definitions:

Securities

Financial instruments that represent ownership positions in corporations (stock), creditor relationships with governmental bodies or corporations (bonds), or rights to ownership as represented by an option.

Subscriptions Receivable

An amount owed by customers for subscription services or products that have been provided but not yet paid for.

Paid-in Capital

Paid-in capital is the amount of money that a company has received from shareholders in exchange for shares of stock, reflecting the capital that has been invested in the company beyond its par value.

Common Stock Subscribed

A commitment by investors to purchase shares of a company's common stock, where the shares are reserved for the subscribers until payment is made.

Q15: Foreaker LLC sold a piece of land

Q18: The sale of land held for investment

Q21: Fred must include in gross income a

Q35: Alvin is a self-employed sound technician who

Q37: Shauna received a $100,000 distribution from her

Q50: Taxpayers traveling for the primary purpose of

Q52: The standard deduction amount varies by filing

Q81: Which of the following statements regarding Roth

Q89: Mike started a calendar-year business on September

Q133: Gross income includes all income realized during