Strumpf Ltd. decides to issue a convertible bond with a maturity of two years. Each bond is issued with a nominal value of £ 100 and an annual coupon C; of course, C has to be determined. Each bond can be redeemed for £ 100 or converted into one share of Strumpf at the option of the bondholder.

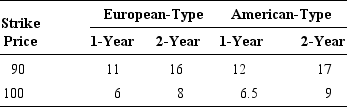

The current stock price of Strumpf is £90. The yield curve for an issuer like Strumpf is flat at 6%. Barings is ready to issue long-term options on Strumpf shares. The premiums on calls with one-year and two-year expirations are given below:

a. American-type calls are more expensive than European-type calls. Is it reasonable?

a. American-type calls are more expensive than European-type calls. Is it reasonable?

b. Assume that the bond can only be converted at maturity, after payment of the second coupon. What should be the fair coupon rate C, consistent with the above market conditions?

c. Assume that the bond is issued with the coupon rate determined above. The yield curve suddenly moves from 6% to 6.1% and the option premiums stay the same. What should be the new market price of the convertible bond?

d. Assume now that the bond can be converted on two dates (rather than one as above). These dates are the first year (right after the first coupon payment) and the second year as above. It is not possible to convert the two-year bond at any other date. Is it possible to construct an arbitrage portfolio allowing to price the fair coupon C with the above data? Be precise in your explanation and state what type of options you would need to price the bond.

Definitions:

Interviews

A method of collecting information through direct conversation, typically used for research or employment selection purposes.

Experimental Research Method

A research methodology that tests hypotheses and establishes cause-effect relationships by manipulating independent variables and observing their effects on dependent variables.

Cause-and-Effect Relationships

The principle that an action or event (cause) will produce a certain response or outcome (effect) in a given context.

Descriptive

Pertaining to the detailed description of characteristics, behaviors, or the setting of an event without imposing any interpretations or judgments.

Q14: The _ was the first major trade

Q17: Twelve associates at Felton Corp. took a

Q20: A patient is terminally ill. The person's

Q30: A person has agoraphobia. This means that

Q63: The process of setting procedures for making

Q68: Management at UniTel discovered that each production

Q77: Describe the role of a line manager.

Q83: Affirmative action occurs when employers<br>A)fill minority quotas.<br>B)establish

Q87: _ are groups of highly trained individuals

Q132: The law requires employers to be able